Good morning and welcome back to Inc.’s 1 Smart Business Story. I hope your readjustment into 2026 is going well.

Today: Thomas Ericsson, the Zyn inventor and kingmaker in the booming smokeless nicotine industry. Ericsson, who Malcolm Gladwell would have certainly dubbed both a maven and a connector if The Tipping Point came out today, is the 74-year-old Swedish pharmaceutical scientist who mainstreamed a category that’s now expected to be a $25 billion market by 2030. Given his vaunted status, founders clamor to meet with Ericsson and get him to bless (and invest in) their nicotine product ideas.

In this, uh, stimulating profile of a man and the entrepreneurial movement he created, you’ll discover:

What Ericsson believes is the next big thing in nicotine replacement therapy in the United States—and the startup founders poised to win

All the ways that founders court Ericsson in an effort to win his approval and secure his involvement in their companies

How startups navigate both the time before they win FDA approval and the ever-present threat of getting crushed by Philip Morris

Who’s the 800-lb. bigfoot in your industry? Let me know at [email protected] and maybe that person will be the subject of a future 1 Smart Business Story. I’ll be enjoying a large iced coffee while I wait for your ideas.

Why Founders Court the Inventor of Zyn When They Want to Disrupt a $5 Billion Industry

Thomas Ericsson, a Swedish pharmaceutical scientist, is the man behind the nicotine frenzy. American startup founders need him in their corner.

BY SAM BLUM, SENIOR WRITER

Photos: Nul presse via Wikimedia Commons; courtesy companies

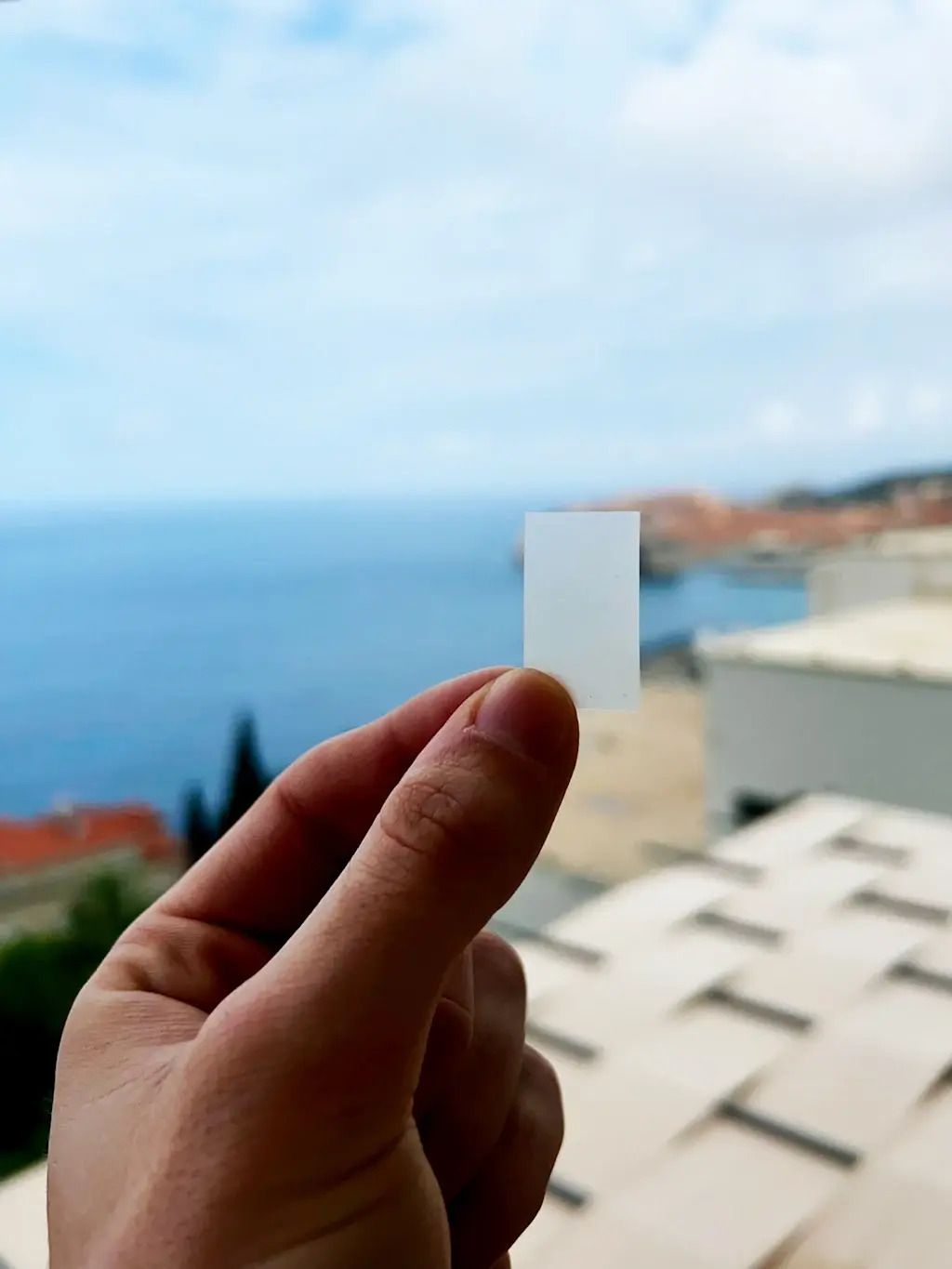

As undergrads at Virginia Tech, Braden Adam and Katherine Ilkhani were convinced they had dreamt up a revolutionary product: a translucent strip that dissolves on the tongue and delivers a strong dose of nicotine—like a Listerine breath strip, but for smokers who want to quit.

Ilkhani, a psychology major, started dating Adam, a computer science major, in 2023. She was an ex-smoker who had become a chronic vape user in college—something that Adam had tried to get her to quit. He hid her vapes and bought her lozenges and gum to stymie her hankerings. Adam also bought Ilkahni flavored nicotine pouches, which are packed into the upper lip, with nicotine seeping into the bloodstream through the mouth. But the pouches made Ilkhani feel sick. So the couple kept brainstorming until they landed on what they thought was a stroke of genius. “We came up with this concept of Listerine strips combined with nicotine,” says Ilkhani.

They conducted months of research in the summer of 2024 and sought out chemical engineers at MIT and Harvard to vet their concept. They earned a fan in Robert Langer, the founder of biopharma giant Moderna, who was the first person to respond to one of Ilkhani’s cold emails. “I thought it was an interesting idea and I was very impressed with her initiative,” Langer recalls.

But there was a problem: Dissolvable nicotine strips already existed—just not as an FDA-approved product in the United States. “There are eight billion people on this earth, and you think you have a unique idea,” says Adam. “But then someone in Sweden has the same thing.”

Zolv’s nicotine strip, which is awaiting FDA approval. Photo: Courtesy company

Nicoccino, which is based in Täby, Sweden, manufactures a patented nicotine strip along the lines of what Adam and Ilkhani had devised. The pair wrote to the company in the summer of 2024 to see if their concept had any viability in the U.S. market. To their surprise, Nicocinno’s CEO, Fredrik Laurell, wrote back. Over several video meetings, Adam and Ilkhani pitched Nicoccino on an agreement to license the product to their new company, Zolv, for sale in the U.S.

“We’re trying to be the first movers in the strip category here in the biggest oral market in the world,” Ilkhani says. Now, Zolv is poised to become the first purveyor of dissolvable nicotine strips in the U.S., pending FDA review.

It was also through these negotiations that the founders met Thomas Ericsson, the 74-year-old Swedish pharmaceutical scientist and silent mastermind of nearly every nicotine product on the market. Ericsson is the second-largest shareholder in Nicoccino and also the inventor of Zyn nicotine pouches, which generated $10 billion in sales in the second quarter of 2025. He says of the white pouches, which debuted in the U.S. in 2014: “We understood that we had something they hadn’t thought about—and that was tobacco-derived nicotine products.”

Today, Ericsson is an evangelist for nicotine strips and believes they are the next evolution of nicotine replacement therapy (NRT) in the United States. He touts their potential to make waves in America via Adam and Ilkhani’s business. “It’s easy to be an entrepreneur when you see that there is a market,” he says.

The beginnings of Zyn

As college campuses abound with kids packing their lips full of Zyn, startups are crowding into the field. Last year, the market was worth $5.39 billion. Still, projections suggest a massive upswing is on the horizon: The global nicotine pouch industry is expected to grow to $25 billion in 2030, according to Grandview Research.

Adam and Ilkhani are lucky to have Ericsson in their corner. To have a puncher’s chance at infiltrating the United States nicotine pouch market, aspiring founders have often sought his blessing, whether it’s through acquiring his patents or having him supervise scientific studies.

In Sweden, nicotine is pervasive and part of the nation’s cultural heritage. Snus, which is tobacco packaged in a delicate pouch, has been consumed since the 1970s as a smoking deterrent, but it first emerged within the country as far back as the 17th century. Due to various government interventions, such as high taxes and marketing restrictions placed on cigarettes, Swedes these days don’t smoke tobacco as much. They do, however, consume nicotine as a standalone vice, making tobacco-alternative products something of a collective pastime.

That’s not necessarily a bad thing; deaths in the country from tobacco products are low compared to other European Union nations, specifically as a result of snus’ popularity, the Harm Reduction Journal determined last year. Still, nicotine pouches and strips are still highly addictive and linked to health problems, like high blood pressure and increased heart rate.

Ericsson spent years developing some of the earliest NRT products on the market, including Nicorette chewing gum. According to The New Yorker, in the ’80s and ’90s, he was a pioneer of so-called “white snus,” a synthetic riff on traditional tobacco-based snus packaged in delicate paper and wedged between the lips and teeth.

An issue with traditional tobacco-based snus is that it looks brown and unpalatable; white snus is arguably more agreeable because it doesn’t have that problem. Ericsson spent years in his garage, tinkering with a chemical formula for white snus that could replicate the jolt of alertness that tobacco provides.

In 2009, Swedish Match, a tobacco conglomerate headquartered in Stockholm, approached Ericsson about bringing his white nicotine pouch to market. It was tested under a few brands and approaches until Zyn was introduced in 2014. Zyn became a regular fixture of convenience store and gas station counters across the U.S. in the early 2020s, and in 2022, Philip Morris International acquired Swedish Match.

The product became a cultural sensation, spawning its own meme lexicon among hyper online bros. Zyn sold more than 202 million packages in the first quarter of 2025, arguably keeping parent company Philip Morris International relevant amid declining appetites for smokable tobacco.

The godfather of the nicotine category

Today, Ericsson is something of a nicotine kingmaker. He says he is bombarded with daily requests for advice and partnerships from fledgling startups around the world.

“He is really the godfather of the category,” says Max Cunningham, founder and CEO of nicotine pouch maker Sesh+. Cunningham, an ex-hockey player and former tobacco user, says he wouldn’t have gotten his company off the ground if not for a trip to Sweden to court Ericsson’s wisdom.

“He had a patent on the particular Sesh formula that we acquired from him. In exchange, he’s a shareholder in the company,” Cunningham explains.

Sesh+ welcomed new funding in September, bringing its total investment to $40 million. Its investors include luminaries from Silicon Valley and the entertainment world. So far, Post Malone, Diplo, and 8VC, the venture fund founded by Palantir co-founder Joe Lonsdale, have all backed the company.

If Zyn is the flagship brand of frat parties, Cunningham says Sesh+ caters more to adults. “You would be surprised just by the range of people who use these products. We have first line responders, we have military, we have police officers … there’s nurses. A lot of people are using these products; they just use them a bit more discreetly,” he explains.

Cunningham isn’t phased by the prospect of vying for market dominance against big tobacco. Phillip Morris “can put a product in 120,000 stores overnight, and they have a lot of influence with retailers,” he says. “But I think the category is evolving so quickly that it creates room for disruptive products.”

Zolv founders Braden Adam and Katherine Ilkhani. Photo: Courtesy company

How Zolv can make it to market—and win

Like Cunningham, the Zolv founders were taken under Ericsson’s wing, and he is advising them through the long, laborious process of bringing their product to market. Currently, they are submitting paperwork for the FDA’s Premarket Tobacco Product Application—a review process that assesses public safety within 180 days of filing.

The FDA typically moves slowly, and Adam cites Zyn’s lengthy approval process as a possible blueprint for Zolv’s ultimate market entry: “Zyn took five years to get authorized. So they just marketed anyway. They sold during that gray area.”

Zolv aims to eke out market share in a space dominated by Philip Morris, the tobacco industry’s oldest monolith—and to push it into the future. Zolv’s founders insist there is an opportunity to carve out a formidable niche.

Illkhani says Zolv purportedly blows other nicotine products out of the water in terms of potency, with a 90 percent nicotine absorption rate within three to five minutes; compare that to a Zyn pouch, where just 40-60 percent of the nicotine is absorbed within 30-60 minutes.

“We’re positioning ourselves in between vapes and pouches, where we take the delivery format from pouches, and then we take the speed from vapes. People who love pouches are a cult following, we’re not targeting those guys,” says Adam. Zolv has no funding yet, but the co-founders say investors have approached them and are assessing options.

Ericsson is a vocal fan, says Ilkhani. “He believes this is going to be the next wave, because there’s such a huge demographic of smokers and vapers who still haven’t been able to adopt pouches because they’re used to that rapid delivery,” she argues.

“You get a very good kick with the nicotine strips,” says Ericsson, who maintains that adding another product to the market can only aid public health. “If you would like to have more people stop smoking, then you should have more competition,” he says.